The Biosimilars Market is entering a period of unprecedented growth. Valued at USD 33.12 Bn in 2024, it is projected to reach USD 82.64 Bn by 2032 at a CAGR of 12.11%, driven by a combination of regulatory support, patent expirations, and growing demand for affordable biologic therapies. Biosimilars, as therapeutic equivalents to reference biologics, are increasingly preferred due to cost-effectiveness, clinical efficacy, and comparable safety profiles.

Key Highlights

Patent Expiries Fuel Launches: The biosimilars segment has gained momentum with the patent expiry of high-revenue biologics, especially monoclonal antibodies and insulin products. This is driving both large pharmaceutical companies and emerging biotech firms to launch cost-effective alternatives.

Monoclonal Antibodies (mAbs) Dominate Pipelines: mAbs account for over 40% of biosimilar pipelines, reflecting strong adoption in oncology and autoimmune disorders.

North America & Europe Lead Market Share: Advanced healthcare infrastructure, supportive reimbursement policies, and streamlined regulatory pathways in the U.S. and EU have positioned these regions as dominant contributors, collectively holding more than 60% of global revenue.

Asia Pacific Expands Rapidly: Driven by healthcare cost-containment pressures, rising biologic therapy adoption, and favorable government initiatives, the APAC biosimilars market is growing at 20%+ CAGR, led by China, India, South Korea, and Japan.

Contract Manufacturing Organizations (CMOs) Boost Capacity: Rising production costs and complex biologics manufacturing have encouraged outsourcing, enhancing market scalability.

Healthcare Cost Reduction: Switching to biosimilars is projected to reduce healthcare costs by up to 30%, particularly in oncology and chronic disease treatment, while improving patient access.

Emerging Markets: Adoption is increasing in Latin America, the Middle East, and Africa due to healthcare system expansion and biologics affordability.

Chart Loading...

Chart ID: 6927f6eb2a2df399f3e9ffb7

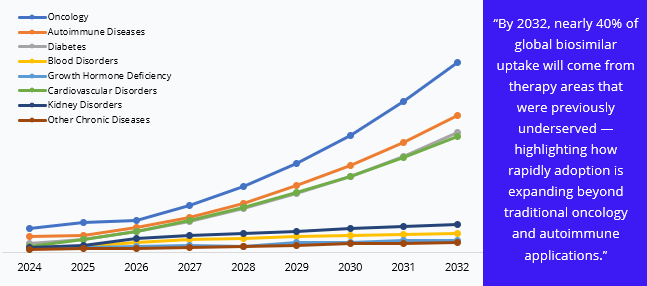

The market’s evolution is particularly visible across therapeutic areas:

Oncology dominates the by Indication/Therapy Area of the biosimilars market, driven by high-cost biologics and increasing cancer prevalence worldwide. Monoclonal antibodies for cancer treatment constitute the largest share, reflecting both strong demand and rapid adoption.

Autoimmune diseases, including rheumatoid arthritis and Crohn’s disease, follow closely, with anti-TNF biosimilars improving treatment accessibility.

Diabetes biosimilars, particularly insulin analogs, are gaining traction in emerging markets due to affordability concerns.

Blood disorders, growth hormone deficiency, cardiovascular, kidney disorders, and other chronic diseases collectively represent smaller but steadily growing segments, fuelled by patent expiries and rising awareness of cost-effective biologic alternatives.

Technological innovations, such as advanced cell line development, bioreactor optimization, and analytical characterization techniques, are improving production efficiency, reducing batch failures, and enabling faster time-to-market for biosimilars.

Regional dynamics reveal a clear divide between established and emerging markets. North America leads with a 42.24% market share, supported by robust regulatory frameworks (FDA interchangeability approvals), advanced healthcare infrastructure, and high prescriber confidence in biosimilars. Europe follows closely by having 33.26% market share, with EMA-guided approvals, tender-based pricing systems, and government cost-containment policies driving adoption. Asia Pacific, however, is expanding at a 15%+ CAGR, led by China, India, Japan, and South Korea, where rising chronic disease prevalence, government initiatives, and the growing biologics manufacturing base are accelerating biosimilar penetration.

Chart Loading...

Chart ID: 6927f95a2a2df399f3e9ffda

The competitive landscape is dominated by multinational pharmaceutical companies such as Pfizer, Sandoz (Novartis), Amgen, Celltrion, and Samsung Bioepis, who collectively control a significant share of global biosimilar approvals and commercialization. Alongside them, emerging innovators like Biocon, Coherus BioSciences, mAbxience, and Oncobiologics are reshaping specialized domains such as monoclonal antibodies, insulin, and growth hormone biosimilars. Contract manufacturing organizations (CMOs) are also increasingly influential, providing scalable production capabilities to meet global demand and ensuring high-quality compliance with stringent regulatory standards.

The defining question for the decade ahead is no longer simply how many biosimilars are launched, but how efficiently and affordably each therapy reaches patients while maintaining clinical efficacy and safety. This market forms the foundational architecture for the next generation of accessible, cost-effective healthcare, redefining patient outcomes, healthcare expenditure, and biologic therapy adoption worldwide.