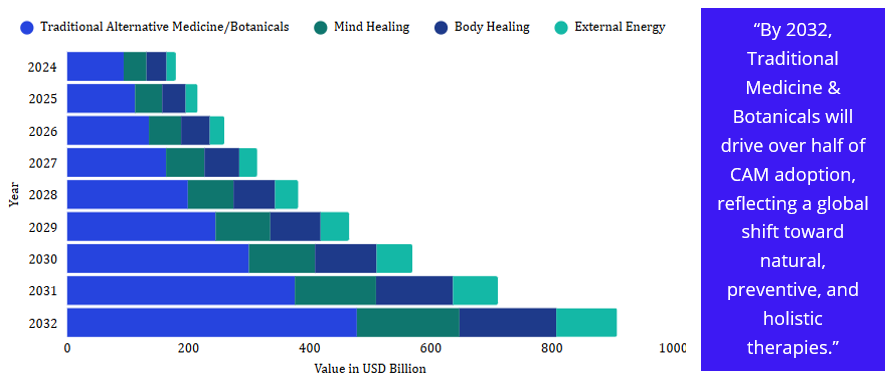

The Complementary & Alternative Medicine (CAM) Market is undergoing a major transformation as global healthcare shifts toward holistic, preventive, and integrative treatments. Valued at USD 179.29 Bn in 2024, the market is set to reach USD 907.34 Bn by 2032, driven by rising demand for natural healing, expanding use of herbal therapies, rapid adoption of mind–body interventions, and the growing momentum of wellness tourism.

Key Highlights

Traditional Medicine & Botanicals lead due to strong demand for natural, preventive healing.

Mind Healing therapies like meditation, yoga, and mindfulness see rapid adoption via digital platforms.

Asia Pacific drives CAM growth with strong traditional systems and government support.

North America & Europe advance integrative care through acupuncture, chiropractic, homeopathy, and wellness programs.

Chronic Disease Management fuels CAM demand for pain, stress, metabolic, and mental health conditions.

Competitive landscape expands as CAM brands grow via partnerships and digital integration.

Chart Loading...

Chart ID: 692d534456772fbd75ae9d3b

The market is segmented by Intervention in (USD Billion, 2024-2032), with each category addressing distinct therapeutic functions and healing approaches.

The Complementary and Alternative Medicine (CAM) Market by Intervention is led by Traditional Alternative Medicine/Botanicals, driven by strong consumer trust in herbal remedies, Ayurvedic formulations, TCM botanicals, and evidence-based natural therapies. Mind Healing is rapidly expanding as meditation, yoga, mindfulness, and holistic psychology gain adoption amid rising mental health concerns and digital burnout.

Body Healing therapies such as chiropractic care, acupuncture, physiotherapy-based CAM, and therapeutic massage continue to grow, supported by global wellness tourism hubs. Meanwhile, External Energy therapies, including Reiki, qigong, pranic healing, crystal healing, and magnetic therapy, are gaining traction due to increasing awareness of spiritual wellness and personalized energy-balancing treatments.

Regional Analysis

Asia Pacific: Fastest-growing region driven by Ayurveda, herbal manufacturing clusters, TCM dominance, and wellness tourism expansion.

North America: Leads in functional medicine, regulated CAM clinics, and digital wellness adoption.

Europe: Strong adoption of homeopathy, naturopathic care, and integrative hospital programs.

Middle East & Africa: Growth driven by wellness resorts, herbal imports, and chronic disease care.

South America: Rising demand for natural healing, energy therapies, and herbal supplements.

Chart Loading...

Chart ID: 692d5bfb56772fbd75ae9e89

The Complementary and Alternative Medicine (CAM) Market is highly fragmented, with key players such as Dabur India Ltd., Gaia Herbs, Inc., Nordic Naturals, Weleda AG, and Traditional Medicinals, Inc. driving innovation across herbal manufacturing, integrative care, nutraceuticals, and digital wellness platforms. Companies compete on portfolio depth, clinical efficacy, patient outcomes, and digital reach, investing heavily in research-backed formulations, AI-enabled diagnostics, personalized herbal solutions, and global distribution networks. Strategic partnerships, wellness tourism expansion, and evidence-based therapy adoption are further strengthening their competitive positioning globally.

The next decade of the Complementary and Alternative Medicine Market will be defined by digital wellness, AI-driven personalization, evidence-based therapies, clinical validation, and integration of CAM with conventional medicine, reshaping global healthcare and wellness ecosystems.