The Fruit and Vegetable Seeds Market is entering a transformative growth phase, driven by rapid advancements in crop genetics, precision farming, and sustainable agriculture. Valued at USD 12,910.12 Mn in 2024, the market is projected to reach USD 22,913.94 Mn by 2032, expanding at a 7.44%. CAGR. Growth is fueled by increasing adoption of hybrid seeds, demand for organic fruit and vegetable seeds, higher commercial farming output, and rising reliance on high-yield seed varieties for ensuring food security.

Key Highlights

Hybrid vegetable seeds continue to dominate due to increased adoption in high-yield farming, improved disease resistance, and large-scale commercial cultivation.

Non-GMO seeds and organic vegetable seeds gain momentum as consumer demand shifts toward clean-label, chemical-free, and sustainability-driven food systems

Regional Updates

Asia Pacific emerges as the fastest-growing region due to expanding horticulture production, rising agri-tech investments, and adoption of high-density crop farming with the highest 38.55% market share.

North America & Europe lead in seed breeding innovation, crop genetics, and commercial seed technologies, driven by advanced agricultural infrastructure.

Competitive landscape strengthens as companies focus on R&D in climate-resilient seeds, seed treatment technologies, high-germination varieties, and expansion across emerging agri-markets.

Chart Loading...

Chart ID: 692d8dcf99bd7b06f5aa460c

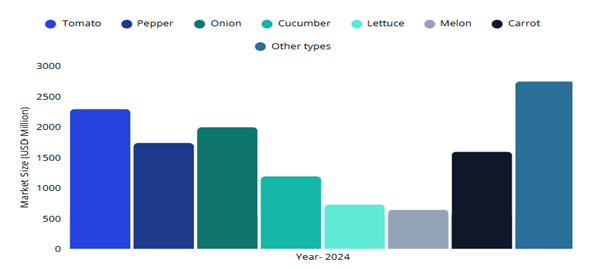

Fruit and Vegetable Seeds market classification by Type in (USD Million, 2024)

Tomato Seeds: Lead due to high global consumption, strong demand for hybrid tomato varieties, improved shelf life traits, and rapid adoption in greenhouse and protected cultivation.

Pepper Seeds: Preferred for high-value cultivation; driven by demand for disease-resistant, export-grade hybrid pepper seeds.

Onion Seeds: Growth supported by large-scale commercial farming, extended storage varieties, and climate-resilient onion hybrids.

Other Types: Include cabbage, cauliflower, beans, and leafy greens driven by regional crop diversity and local consumption patterns

Fruit and Vegetable Seeds Market Growth by Family Type (USD Million, 2024)

Chart Loading...

Chart ID: 692d910499bd7b06f5aa463b

Regional Analysis

Asia Pacific: Fastest-growing region, supported by expanding horticulture output, agri-tech penetration, and strong demand for hybrid vegetable seeds.

Europe: Strong adoption of high-quality commercial seeds, greenhouse cultivation, and sustainability-driven seed innovations.

North America: Leads in advanced seed technology, precision-agriculture tools, and adoption of non-GMO and organic seeds.

Middle East & Africa: Growing demand due to water-efficient farming systems and adoption of drought-resistant seeds.

South America: Increasing horticulture exports and adoption of hybrid fruit and vegetable seeds.

Chart Loading...

Chart ID: 692d91c599bd7b06f5aa465b

The Fruit and Vegetable Seeds Market remains highly competitive as companies intensify investments in breeding innovation, high-germination hybrids, trait improvement, and crop genetics to boost yield performance. Key priorities include R&D collaborations, stronger seed testing, climate-smart seed development, and wider global distribution to meet rising demand from open-field and protected cultivation.

Over the next decade, advancements in seed technology, precision agriculture, and sustainable seed treatments will reshape horticulture—strengthening supply chains, improving farmer profitability, and accelerating the adoption of non-GMO, organic, and drought-tolerant varieties across global markets.