The Smart Factory Market is entering a phase of substantial digital transformation, expanding from USD 1,67.02 Bn in 2025 to USD 335.83 Bn by 2032, growing at a CAGR of 10.49%, supported by strong momentum in industrial automation, IoT-connected manufacturing systems, AI-driven production optimization, and cloud-based manufacturing analytics.

Key Highlights

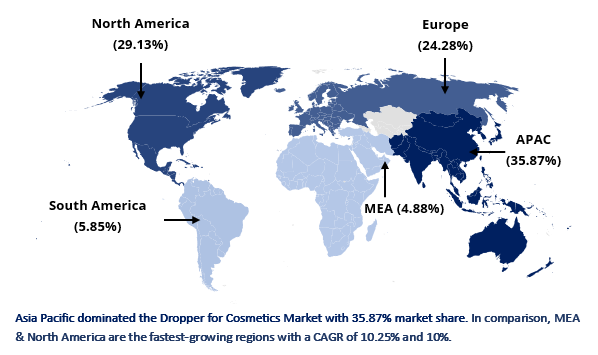

Asia Pacific dominated the market with 35.87% share, driven by large-scale automation in automotive, electronics, and semiconductor manufacturing along with government incentives for Industry 4.0 adoption.

North America remains a high-value market led by the rapid implementation of AI-enabled smart factory automation systems, predictive maintenance, and cloud robotics.

Europe demonstrates strong regulatory-backed momentum in energy-efficient manufacturing, sustainable smart factory operations, and adoption of ERP, DCS, and PLM systems.

The combined market share of the Automotive and Semiconductor & Electronics application segments exceeds 41%, reflecting accelerated adoption of industrial robotics, MES-driven production control, PLC-integrated automation, and machine vision–based quality assurance across highly demanding manufacturing environments.

Rising focus on cybersecurity, interoperability, and scalable digital twin architecture is accelerating smart factory modernization across sectors.

Growing demand for AI-driven manufacturing intelligence, robotic automation, and connected field devices is promoting advancements in autonomous decision-making, zero-downtime operations, and highly agile production value chains.

Chart Loading...

Chart ID: 6938fe9bd12c34671af6be4b

Smart Factory Market Analysis by Technology (2025–2032): Adoption Trends & Growth Insights

Manufacturing Execution System (MES) leads the segment with more than 22% market share, driven by demand for real-time production visibility, compliance tracking, and workflow optimization.

Distributed Control Systems (DCS) and Supervisory Control and Data Acquisition (SCADA) continue strong adoption for centralized monitoring and automated plant control.

Programmable Logic Controllers (PLC) remain core to factory automation, while HMI, ERP, and PLM gain momentum through integration with AI and IoT-based ecosystems.

Chart Loading...

Chart ID: 6938ff1ad12c34671af6be54

Regional Analysis

Asia Pacific: 35.87% market share led by strong robotics adoption and large manufacturing capacity.

North America: Growth supported by AI, cloud-based MES, and predictive maintenance platforms.

Europe: Leadership in sustainability-driven automation, ERP integration, and advanced PLC/SCADA deployment.

Middle East & Africa: Growing with a CAGR of 10.25% and increasing adoption of automation for oil & gas and energy infrastructure.

South America: Gradual modernization in automotive and manufacturing industries.

The smart factory ecosystem is competitive with key players including Siemens, ABB, Rockwell Automation, Schneider Electric, Bosch, Honeywell, Emerson, and Mitsubishi Electric. These companies focus on innovations in AI-driven automation, digital twin ecosystems, smart sensors, robotics, and cybersecure Industry 4.0 platforms.

From 2025–2032, strategic priorities will revolve around AI-enabled connected manufacturing, autonomous production systems, edge-to-cloud integration, and supply chain digitalization, shaping the future of the global Smart Factory Market.