The Pulp and Paper Market is undergoing a major transformation, expanding from USD 484.84 Bn in 2025 to USD 574.41 Bn by 2032 at a CAGR of 2.45%, supported by strong momentum in packaging paper, recycled paper, wood pulp, and advanced pulp production technologies.

Key Highlights

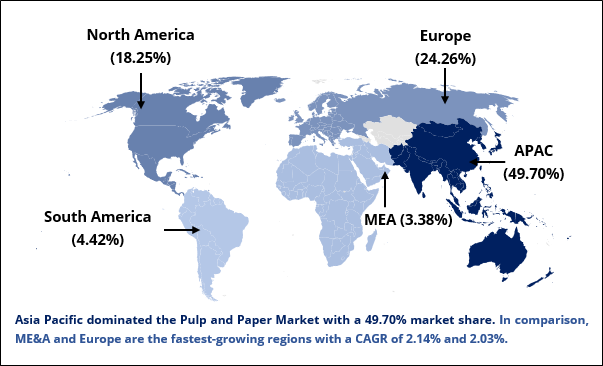

Asia Pacific leads the pulp and paper market with 49.70% share, driven by large-scale pulp production capacity, rising packaging consumption, and expanding exports from China, Indonesia, and India.

Europe stands at the forefront of sustainability-led growth, driven by strict environmental regulations and rapid adoption of recyclable and fibre-based packaging solutions.

North America remains a high-value market, supported by premium paper grades, sustainable forestry practices, and strong penetration of digitalized, automated paper mills.

Wrapping and Packaging Paper accounts for the largest share, fuelled by global e-commerce growth, rising logistics volumes, and consumer preference for plastic-free packaging.

Recycled Paper and recovered fibre consumption increases steadily as companies pursue net-zero targets and circular economy strategies.

Growing demand for advanced paper products is driving innovations in fibre chemistry, process optimization, and sustainable sourcing, while AI-driven automation and energy-efficient pulping enhance cost and environmental performance.

Chart Loading...

Chart ID: 6936c12a941d36a236ebb0d2

Pulp and Paper Market Breakdown, By Category for 2025-2032

Wrapping and Packaging leads the pulp and paper market with 45.17% market share, driven by demand for sustainable paper packaging, kraft paper, and recyclable materials, supported by e-commerce growth.

Painting and Writing remains steady, backed by office and specialty papers and advancements in paper manufacturing technology.

Sanitary products grow with hygiene awareness, recycled paper market integration, and advanced pulp processing.

Chart Loading...

Chart ID: 6936c1ba941d36a236ebb0db

Regional Analysis

Asia Pacific: 49.70% market share supported by large-scale pulp capacity, high consumption, and integrated forestry-to-paper models.

North America: The region is driven by digitalized mills, rising tissue demand, and sustainable forestry certifications.

Europe: Strong growth with a CAGR of 2.03%, Leadership in eco-friendly paper and compliance-driven product innovations.

Middle East & Africa: The region is witnessing growing demand for packaging paper and hygiene-grade products, registering a CAGR of 2.14%.

South America: Major hub for low-cost pulp production, primarily in Brazil and Chile.

The pulp and paper industry remains competitive with global players including International Paper, WestRock, UPM-Kymmene, Stora Enso, DS Smith, Suzano, Nine Dragons Paper, Sappi, Asia Pulp & Paper (APP), and Mondi.

From 2025–2032, strategic priorities will revolve around sustainable paper packaging, energy-efficient pulp production, digitized manufacturing, fiber circularity, and value chain transformation, defining the future of the global pulp and paper market.