The Anime Market is valued at USD 34,683.89 Mn in 2025 and is expected to reach USD 66,212.59 Mn by 2032, at a CAGR of 9.46% as studios, distributors, and OTT platforms invest in high-quality animation, cross-border licensing, and global streaming partnerships. The growing international fanbase, particularly Gen Z and Millennials, is boosting consumption across streaming, theatrical releases, gaming adaptations, live events, and merchandise.

Key Highlights

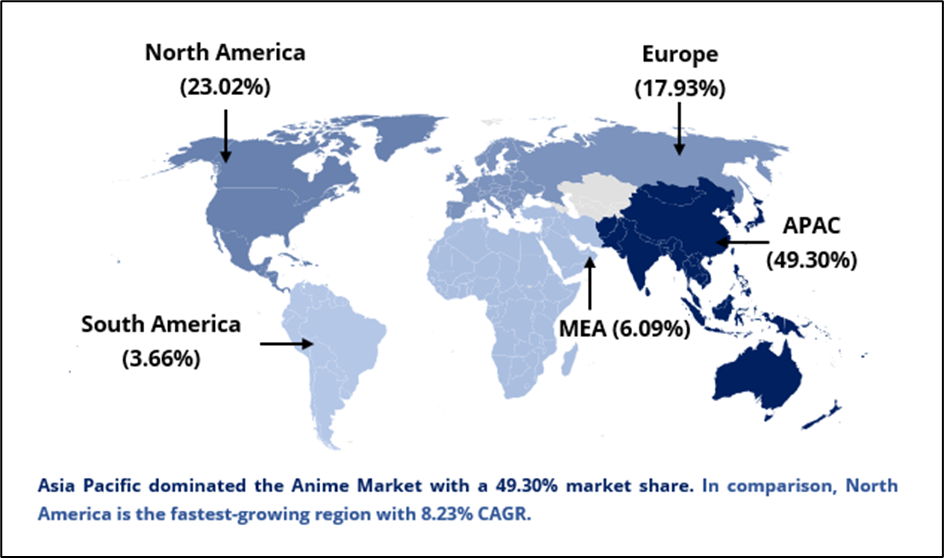

Asia Pacific dominates the Anime Market with a 49.30% share, driven by Japan’s production strength and rising consumption in China and South Korea. In comparison, North America is the fastest-growing region with a CAGR of 8.23%, supported by expanding anime streaming, higher merchandise spending, and strong theatrical releases.

OTT/Streaming Platforms hold the largest distribution share at 41.20%, led by Netflix, Crunchyroll, Disney+, and Amazon Prime.

Merchandising & licensing remain the biggest profit contributors, driven by character goods, gaming collaborations, fashion tie-ups, and collectibles.

Market competition intensifies with studios exploring AI-assisted animation, global co-productions, IP-based gaming, and advanced digital distribution models.

Rising demand for digital anime content, localized dubbing, and immersive storytelling is reshaping production strategies. Platforms increasingly focus on exclusive anime titles, simul-release strategies, and AI-powered content recommendation, while investors emphasize IP monetization, franchising, and multimedia expansions into games, comics, and live-action adaptations.

Chart Loading...

Chart ID: 69315b1caf2c9c7897f2f9b9

Anime Market Breakdown, By Distribution Channel for 2025-2032

OTT/Streaming Platforms dominate the market, driven by subscription models, global content availability, simulcasts, and AI-driven personalization.

Television Broadcasting remains relevant in Asia for legacy consumption, franchise building, and promotion of new titles.

Theatrical Releases contribute premium revenue through event films, fan screenings, and franchise-based blockbusters.

Physical & Digital Media (Blu-ray, collectibles, NFTs) retain importance among dedicated collectors and superfans.

Chart Loading...

Chart ID: 69315c8c145865ff77809054

Regional Analysis

Asia Pacific: Largest market with 49.30% share, supported by strong production output, cultural influence, and increasing role of China and South Korea in anime consumption.

North America: Fastest-growing region due to rising anime streaming penetration, strong manga sales, and expanding merchandise ecosystem.

Europe: Growth driven by localization, expanding anime events, and rising interest in anime-based games and collectibles.

Middle East & Africa: Increasing anime viewership, driven by youth demographics and wider platform availability.

South America: Rapid growth from expanding mobile streaming, community-driven anime culture, and rising cosplay and fan events.

The Anime Market remains competitive with key players including Toei Animation, Aniplex, MAPPA, Studio Ghibli, Sunrise, Kadokawa, Netflix Anime, Crunchyroll, Funimation, and emerging global production studios.

From 2025–2032, strategic focus will center on streaming-led revenue models, IP monetization, regional co-productions, AI-enhanced animation workflows, and global franchise development, setting the stage for the next era of the global anime industry.