The Aircraft Wheels and Brakes Market is projected to grow from USD 8,508.97 Mn in 2024 to USD 14,087.79 Mn by 2032, reflecting a 6.51% CAGR. Growth is driven by rising adoption of advanced braking technologies, increased demand for aircraft landing gear upgrades, carbon brake innovations, and fleet modernization across commercial, military, and business aviation.

Key Highlights

North America leads the market with 34.81% market share, strong aftermarket demand, and a large operating fleet.

Europe accelerates carbon brake adoption due to sustainability and lightweight component focus.

Asia Pacific posts the fastest growth, driven by airline expansion and rising MRO investments.

Carbon brakes gain strong traction for lower weight, better heat management, and longer lifecycle.

Landing gear MRO and brake refurbishment surge with higher flight cycles and aging fleets.

Market competition intensifies as OEMs expand predictive maintenance and anti-skid technology.

The Aircraft Wheels and Brakes Market is expanding as airlines, defence operators, and MROs prioritize landing safety, operational efficiency, and lifecycle optimization. Fleet renewal programs and rising narrow-body deliveries are driving adoption of carbon brakes, anti-skid braking systems, wheel-speed sensors, and advanced rotor–stator assemblies.

Demand is strong across commercial, military, and business aviation as regulators enforce strict braking performance standards. Manufacturers continue investing in digital monitoring, brake-wear indicators, lightweight alloy wheels, and next-generation electric braking systems, strengthening long-term market opportunities.

Chart Loading...

Chart ID: 693124e9adb0859f251a72d5

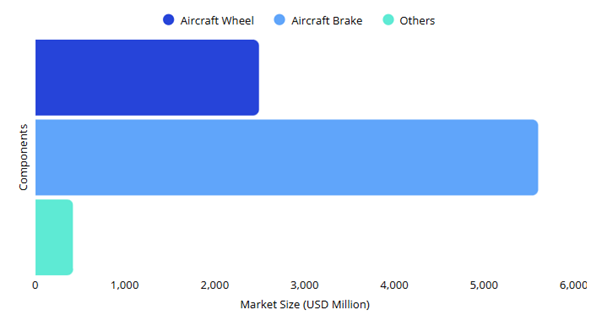

Aircraft Wheels and Brakes Market Breakdown, By Component for 2024-2032

Aircraft Brakes dominate the market with 65.82% market share, driven by the widespread transition from steel to carbon brake discs, which offer superior heat management, reduced weight, and significantly longer lifecycle benefits.

Aircraft Wheels remain essential, supported by their regular replacement intervals, increasing flight frequencies, and mandatory safety inspections that require periodic wheel assembly checks.

Other Components include torque tubes, pressure plates, refurbishment kits, and lightweight alloy wheels used across commercial, regional, and defence aircraft fleets.

Chart Loading...

Chart ID: 69312c789c3e575b92de7052

Regional Analysis

North America: Leads due to the largest operating fleet globally, strong MRO ecosystem, and rising investments in digital brake monitoring and carbon brake upgrades.

Europe: Growth driven by sustainability mandates, carbon brake adoption, and strong aerospace manufacturing clusters.

Asia Pacific: Fastest-growing region with CAGR of 7.61% and 24.72% market share owing to rapid fleet expansion, airline modernization, and new-generation aircraft deliveries.

Middle East & Africa: Growth supported by wide-body aircraft operations, strong MRO hubs, and increasing safety modernization.

South America: Expanding demand due to regional airline growth, increased runway operations, and rising replacement part procurement.

Chart Loading...

Chart ID: 69312774adb0859f251a72f6

The Aircraft Wheels and Brakes Market remains competitive with major players including Collins Aerospace, Safran Landing Systems, Honeywell Aerospace, Parker Hannifin, Meggitt (Parker), Wheeling Aviation, Crane Aerospace, and global MRO operators specializing in wheel and brake overhaul.

From 2025 to 2032, strategic focus on fleet renewal, carbon brake adoption, predictive maintenance, and lightweight landing gear technologies will be the primary accelerators shaping market growth and operational efficiency worldwide.