The Agricultural Tractors Market is witnessing strong structural expansion, growing from USD 52.13 Bn in 2025 to USD 103.95 Bn by 2032, supported by rapid farm mechanization, increasing reliance on agricultural equipment, and the global shift toward advanced farming practices. Rising demand for high-efficiency tractors, strengthening investments in precision agriculture, and continuous innovation among tractor manufacturers are transforming operational productivity for farmers worldwide.

Key Highlights

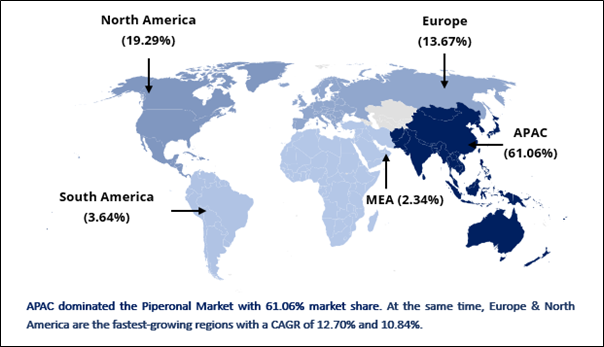

Asia Pacific leads the Agricultural Tractors Market with over 61.06% market share, driven by high agricultural output, large-scale farming activities, and strong demand for utility tractors, especially in India and China.

North America remains a high-value market with 19.29% share, supported by high adoption of precision farming equipment, advanced tractor technologies, and growth in autonomous tractors.

Europe holds 13.67% share, fueled by rapid electrification, sustainability-focused farming reforms, and demand for high-HP tractors.

Utility tractors dominate with 33.55% share, backed by their versatility, high demand among small & mid-size farmers, and suitability across cropping patterns.

High-horsepower tractors (100+ HP) continue to show strong growth due to rising demand in large agricultural fields, commercial farming, and row-crop operations.

Strategically, manufacturers are focusing on connected tractor platforms, expanding global dealer networks, developing electric and autonomous tractor fleets, and strengthening aftermarket service portfolios to enhance revenue visibility.

Chart Loading...

Chart ID: 69390885489253e723cf0949

Agricultural Tractors Market Segmentation, By Engine Capacity (2025–2032): Strategic Breakdown & Growth Insights

Below 40 HP: High-volume demand in Asia Pacific and Africa, fueled by small landholdings, cost-sensitive farmers, and compact farm operations.

41–100 HP: Strong adoption with market share of 35.14% across mixed, orchard, and medium-scale commercial farms, supported by versatility, moderate fuel efficiency, and multi-crop applications.

101–200 HP: Rapidly growing segment, driven by large-scale commercial farming, higher productivity requirements, and precision farming adoption, capturing a significant market share globally.

Above 200 HP: Niche but high-value segment, favored in large plantations, industrial-scale farms, and high-mechanization regions, with rising interest in autonomous and connected tractor technologies.

Chart Loading...

Chart ID: 69390a50489253e723cf095b

Regional Analysis

Asia Pacific: Largest regional contributor with XX% share; strong support from farm modernization programs and large tractor production capacity.

North America: Driven by the adoption of smart agriculture, autonomous driving technologies, and advanced precision equipment.

Europe: Strong focus on electric tractors, low-emission farming, and sustainability-driven agricultural policies.

Middle East & Africa: Growth driven by agricultural development programs, irrigation expansion, and growing mechanization needs.

South America: Significant traction from Brazil and Argentina due to rising demand for high-HP tractors for large farms.

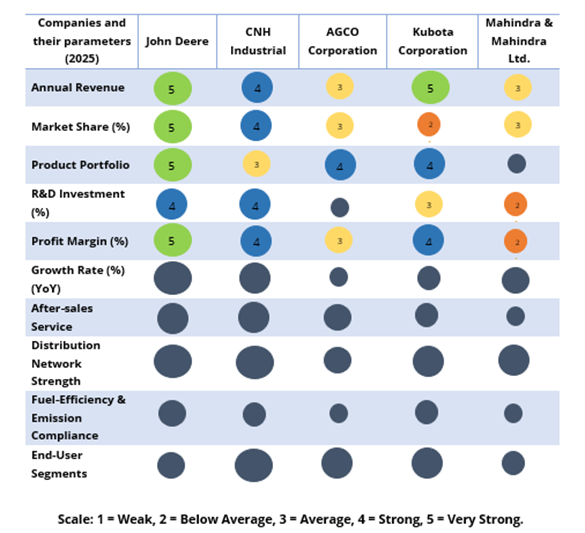

John Deere, CNH Industrial (New Holland & Case IH), AGCO Corporation, Kubota Corporation, CLAAS, Mahindra & Mahindra, Yanmar, TAFE, SDF Group, Deutz-Fahr, and regional tractor manufacturers. These companies focus on precision farming innovation, electric tractor development, strategic capacity expansion, robotics integration, and digital service-based revenue models.

From 2025–2032, strategic priorities in the Agricultural Tractors Market will focus on enhancing fuel efficiency, precision farming integration, and digital connectivity, while driving after-sales service optimization, cost-effective production, and adoption of sustainable, low-emission tractor technologies.