Key Highlights

Transmission and distribution operators are increasing investments in predictive maintenance, thermographic inspections, and digital substation monitoring to reduce downtime, outages, and lifecycle costs.

High-voltage substation maintenance gains strong momentum as utilities focus on grid resilience, renewable energy integration, and aging infrastructure replacement.

Asia Pacific emerges as the fastest-growing region, driven by rapid electrification, capacity expansion, smart grid projects, and increasing adoption of substation testing and maintenance services.

North America & Europe lead in digital O&M adoption, SCADA-enabled monitoring, asset health analytics, and condition-based maintenance frameworks.

The competitive landscape strengthens as global players expand service portfolios across substation repair and maintenance, switchgear inspection, transformer testing, and relay protection system maintenance.

The substation maintenance market is driven by ageing grid infrastructure, renewable energy integration, and rising investments in smart grid–oriented substation services. Utilities are increasingly deploying AI-based fault detection, IoT-enabled substation monitoring, digital diagnostics, and condition-based maintenance to minimize outages and optimize lifecycle performance. Regulatory pressure around equipment reliability, protection systems, and environmental compliance is further accelerating demand for long-term substation maintenance contracts.

Chart Loading...

Chart ID: 692e9f9ff49beb5ca9a11b7e

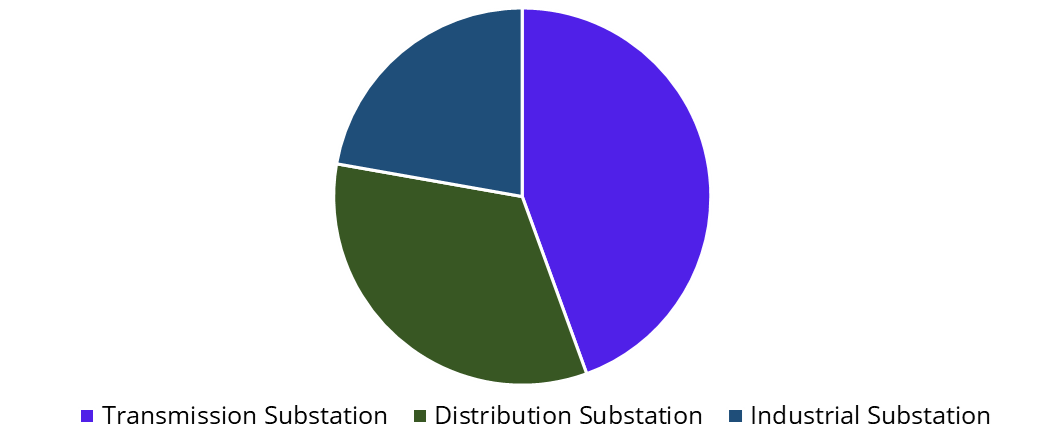

Substation Maintenance Market Classification by Substation Type with Growth Outlook

Transmission Substations dominate due to large-scale grid upgrades and the rising need for high-voltage substation maintenance, including transformer inspection, circuit breaker testing, and GIS/GIL servicing.

Distribution Substations grow steadily with smart meter rollout, rising electricity demand, and expansion of urban and rural networks. Adoption of SCADA-enabled monitoring and switchgear preventive maintenance enhances segment performance.

Industrial Substations expand with manufacturing growth, data center development, and investments in captive power infrastructure, relying heavily on condition monitoring, thermographic inspections, and outsourced O&M to ensure uptime and operational continuity.

Chart Loading...

Chart ID: 692ea151f49beb5ca9a11b90

Regional Analysis

Asia Pacific: Fastest-growing region driven by grid expansion, high-power demand, and utility investments in predictive substation maintenance and digital O&M frameworks.

Europe: Strong adoption of smart grid and digital substation technologies, adherence to reliability standards, and modernization of aging electrical networks.

North America: Leads in substation automation, AI-driven diagnostics, asset health monitoring, and upgrades of aging T&D infrastructure.

Middle East & Africa: Growth driven by industrialization, renewable energy deployments, and investments in HV substations for grid stability.

South America: Increasing government-led grid upgrades and expansion of substation testing and maintenance services.

Chart Loading...

Chart ID: 692ea210f49beb5ca9a11b99

The Substation Maintenance Market remains competitive as providers enhance capabilities in digital diagnostics, predictive maintenance, advanced testing, and lifecycle O&M. Leading players such as ABB, Siemens Energy, GE Grid Solutions, Schneider Electric, and Eaton are expanding high-voltage maintenance, transformer testing, switchgear inspection, and relay protection services. Growing adoption of IoT monitoring, AI-based fault analytics, and condition-based models is improving accuracy and service efficiency.

From 2025–2032, the market will grow steadily as utilities invest in smart grid modernization, renewable integration, and digital substation upgrades. Rising electricity demand and aging assets will boost spending on automation, remote diagnostics, and long-term O&M contracts, driving the shift toward self-monitoring, digitally optimized substations worldwide.