The Dropper for Cosmetics Market is witnessing strong structural expansion, projected to grow from USD 93.77 Mn in 2025 to USD 127.90 Mn by 2032, at a CAGR of 4.53%. Growth is underpinned by rapid innovations in cosmetic dropper packaging, premiumization of skincare and haircare formulations, and increasing adoption of glass dropper bottles, dropper caps and closures, and child-resistant droppers by top beauty brands.

Key Highlights

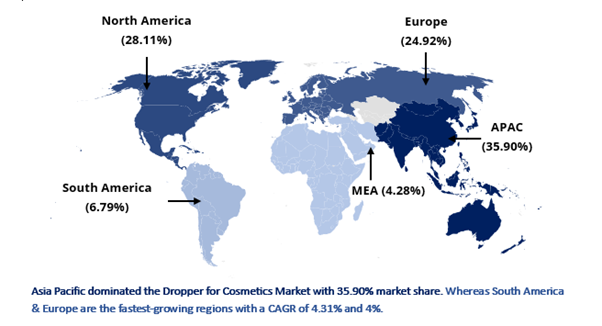

Asia Pacific dominated the market with a 35.9% share, driven by strong growth in skincare consumption, large-scale manufacturing of dropper bottle packaging solutions, and rising exports from China, South Korea, and India.

North America remains a high-value market backed by premium skincare brands, strong adoption of tamper-evident dropper bottles, and rising demand for sustainable packaging formats such as recyclable glass dropper bottles.

Europe leads the transition toward eco-friendly cosmetic packaging, supported by strict sustainability regulations, accelerated shift toward post-consumer recycled (PCR) materials, and strong demand for luxury serums and facial oils.

Skincare Applications account for the highest share with 51.43%, driven by the booming anti-aging segment, hyaluronic acid serums, vitamin C formulations, and the rise of clean beauty brands.

Sustainable Packaging emerges as a top priority as beauty manufacturers move toward recyclable glass, bio-based plastics, and refillable dropper systems to meet ESG compliance and reduce packaging waste.

Driven by innovation in precision dispensing technologies, material engineering, sustainable supply chain processes, and improved compatibility testing for cosmetic actives, market players are investing heavily in design optimization, lightweighting, and manufacturing automation.

Chart Loading...

Chart ID: 6936b9aebf23facb17bfe5db

Dropper for Cosmetics Market Segmentation by Product Type (2025–2032): Strategic Breakdown & Growth Insights

Glass Droppers lead the market with the largest share, favored for premium cosmetics, sustainability, chemical resistance, and luxury positioning.

Plastic Droppers continue to grow with a 3.72% CAGR across mass-market brands, supported by cost efficiency, lightweighting, and innovations in HDPE and PET dropper bottles.

Chart Loading...

Chart ID: 6936c0a0941d36a236ebb0c3

Chart Loading...

Chart ID: 6936c29b941d36a236ebb0f5

Regional Analysis

Asia Pacific: 35.90% market share backed by leading cosmetic production hubs, low-cost manufacturing, and strong demand for dropper bottle manufacturers.

North America: Driven by premium beauty brands, clean beauty trends, and strong adoption of precision dispensing dropper systems.

Europe: Strong CAGR of 4%, led by sustainability-focused cosmetic packaging innovations and luxury skincare growth.

Middle East & Africa: Increasing demand for premium skincare and serum-based products boosts adoption of glass droppers.

South America: Rapid growth with a CAGR of 4.31% of local cosmetic brands and rising interest in essential oils support steady market expansion.

The market is competitive with key players including AptarGroup, Virospack, Quadpack, Lumson, Bormioli Luigi, Comar, Berlin Packaging, Stoelzle Glass Group, and HCP Packaging, focusing on innovation in glass droppers, precision dispensing systems, sustainable materials, and advanced molding technologies.

From 2025–2032, strategic priorities will revolve around sustainable cosmetic packaging, refillable dropper systems, advanced material engineering, AI-enabled quality inspection, and value chain optimization—shaping the future of the global Dropper for Cosmetics Market.