The Air Motor Market is propelled by industrial automation, rising uptake of air powered motor solutions, and the shift toward maintenance-free, contamination-free, and energy-optimized pneumatic technologies. Manufacturers are increasingly deploying compressed air motors, pneumatic drive solutions, and digital torque-controlled systems to improve productivity, simplify maintenance, and ensure operational safety in hazardous zones.

Key Highlights

Asia Pacific held the largest market share of 36.16% in 2024, driven by strong manufacturing, automation adoption, and widespread use of pneumatic motors across industrial sectors.

North America and Europe, with 27.60% and 21.79% market share after APAC advances in oil-free and energy-efficient pneumatic technologies, adopting torque-controlled systems and sustainable compressed-air solutions.

Explosion-proof air motor demand rises, as oil & gas, chemical, and petrochemical industries shift toward spark-free, high-reliability pneumatic drive systems

Adoption of vane, gear, and piston air motors accelerates, supporting safe, efficient, and low-maintenance power delivery across automated production and hazardous environments.

Competitive intensity increases, with global players expanding portfolios in air powered motors, lightweight pneumatic drives, and low-speed high-torque motors for OEM applications.

Trends such as IIoT-enabled air consumption monitoring on production lines, lightweight modular motors for handheld tools and cobots, and sustainability-focused compressed-air optimization programs are further shaping OEM specifications and retrofit decisions. Long-term growth is supported by regulatory emphasis on safe mechanical drive systems, reduced emissions, and enhanced equipment uptime across industries.

Chart Loading...

Chart ID: 692eef402592d6f12835aa94

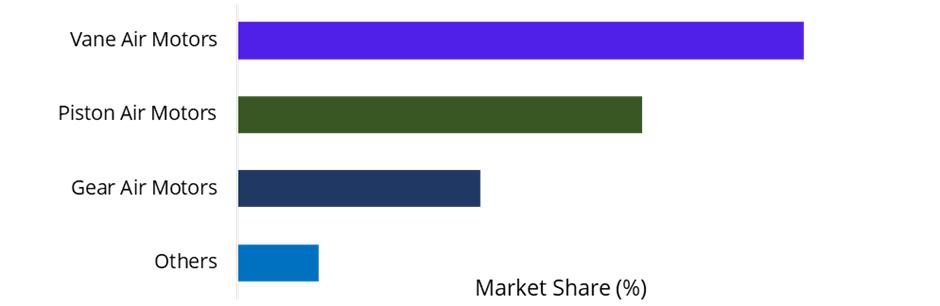

Air Motor Market Breakdown, By Type for 2024-2032

Vane Air Motors dominate due to versatility, compact design, smooth torque delivery, and widespread integration in food processing, packaging, and general manufacturing.

Piston Air Motors expand steadily as industries adopt precise, high-power pneumatic systems for drilling, stirring, and specialized automation tasks.

Gear Air Motors register strong growth owing to high-torque performance, durability, and suitability for heavy-duty industrial applications.

Chart Loading...

Chart ID: 692eefe22592d6f12835aaa3

Regional Analysis

Asia Pacific: This region dominated the Air Motor Market in the year 2024 due to strong manufacturing activity, automation adoption, and rising installation of industrial pneumatic motors across production facilities.

North America: Leads in high-precision low-speed high-torque air motors, explosion-proof pneumatic solutions, and applications across automotive and industrial automation.

Europe: Growth supported by high focus on workplace safety, energy-efficient compressed-air systems, and OEM demand for air powered motors.

Middle East & Africa: Growth driven by petrochemical expansions and increased deployment of spark-free pneumatic drive systems.

South America: Market expansion supported by manufacturing modernization and adoption of pneumatic motor technologies in food, mining, and process industries.

Chart Loading...

Chart ID: 692ef0782592d6f12835aaac

The Air Motor Market remains competitive, with leading manufacturers such as Atlas Copco, Ingersoll Rand, Parker Hannifin, DEPRAG, and Globe Air Motors expanding portfolios in high-performance pneumatic motors, torque-optimized systems, and OEM-specific air motor assemblies.

Rising adoption of industrial air motors, energy-efficient compressed air technologies, and digitally monitored pneumatic solutions will drive market expansion from 2025–2032. Growth will be supported by industrial automation, safety compliance, and the shift toward clean, cost-efficient, and maintenance-optimized air-powered drive systems worldwide.